The Racism of Wealth Inequality in the United States

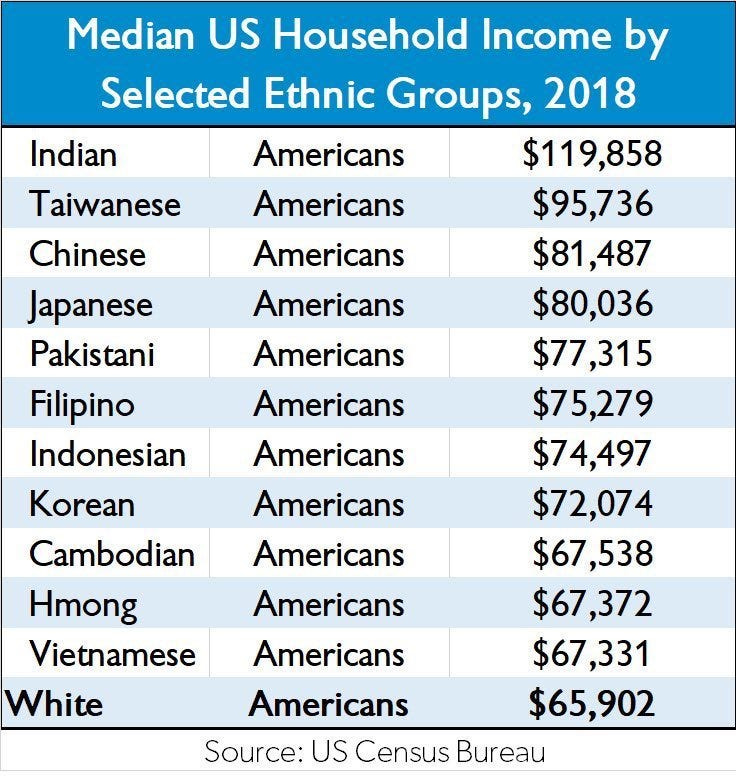

The other day, I was scrolling through Twitter — yes, I know it’s called X now, but I refuse to call it that, and you know what I mean when I say Twitter — and I came across a retweet by Elon Musk. It read, “Wow, America really is the land of opportunity,” above a tweet by The Rabbit Hole, who shared a table showing the median US household income by selected ethnic groups from 2018. The Rabbit Hole commented, “Some of the most successful people in the United States are from minority groups.” The table only included Asian Americans and white Americans, with Indian Americans at the top, having the highest median household income of $119,858. Vietnamese Americans were at the bottom among Asian Americans, and white Americans, whose median household income was just under $1,000 less than Vietnamese Americans, were listed last.

I was hesitant to click on the post to read the reactions because I already knew what to expect: a barrage of anti-Black and anti-Brown rhetoric about how Asian Americans are such good model minorities and embody the idea of meritocracy. I wasn’t wrong, and antisemitism was also thrown into the mix.

Sam Parker, a failed Utah Senate candidate in the 2018 election, asked, “How come they didn’t show the one with the Jewish number?” He attached a screenshot of median household income in the United States by ethnic group from the 2013–15 American Community Survey. In this graphic, Jewish Americans had the highest median income at $129,000/year, followed by Indian Americans at $100,500. White Americans were listed as the 10th highest median household income at $59,900, while Hispanic/Latino Americans and African Americans were at the bottom with median household incomes of $43,000 and $35,000, respectively.

Parker found company in the responses to Musk’s post, with great-replacement-theory believers like Bullzeye stating, “Yes, the land of opportunity for everyone but the people whose homeland it is, thanks to one specific group rigging every institution to ensure Whites are at a disadvantage.” This comment included a link to a tweet from March 2024 about naturalization in the United States, which stated, “In fact, America’s founding fathers ‘limited naturalization to immigrants who were free White persons of good character’ for the majority of our history. It was never meant to be a ‘melting pot’ of races that don’t respect our culture or heritage.”

While many race-conscious individuals might shrug off these tweets as the same old racist and antisemitic tropes that arise whenever the right discusses income inequality in the United States, it is imperative to push back against bad-faith claims not rooted in actual facts and data. Those on the right who consistently rely on meritocracy, the model minority myth, antisemitic tropes, and great replacement theory myths fail from the beginning because their arguments lack a factual basis.

Demographics

Let’s start by understanding that in order to look at the racial wealth gap in the United States, one must consider all races, not just Asian and white folks. According to the US Census, in July of 2023, the racial makeup of the United States was as follows:

- White 75.3%

- Black or African American 13.7%

- American Indian and Alaska Native 1.3%

- Asian 6.4%

- Native Hawaiian and Other Pacific Islander 0.3%

- Two or More Races 3.1%

- Hispanic or Latino 19.5%

- White alone, not Hispanic or Latino 58.4%

Given that Sam Parker introduced the antisemitic trope of Jews controlling all the wealth into the conversation, it is also important to understand the racial makeup of ethnic Jews in the United States. American Jews make up 2.4% of the total US population, whether or not they identify as religious. The Jewish racial makeup of the US is as follows:

- White 92%

- Black 1%

- Asian <1%

- American Indian <1%

- Hawaiian/Pacific Islander <1%

- Other <1%

- Two or more races 2%

- Hispanic and White 2%

- Hispanic and other/multiple races 2%

I will not be reporting out on Jewish-specific data in this article. The majority of Jews in America are white and when discussing wealth distribution in the US, it is safe to assume their numbers are represented in the data listed under white Americans.

Asian Americans and the Model Minority Myth

The myth of model minority is based in stereotypes. It is a narrative that white Americans have created about Asians in America that perpetuates a system of racism and harm. The model minority myth erases differences among individuals, ignoring the diversity of Asian American cultures. The myth perpetuates a belief of Asian Americans as perpetual foreigners and as a group of people who do not experience racism, both systemically and interpersonally.

Asian Americans as a Monolith

When it comes to discussing race in the United States, nothing brings out the anti-Black racism more than touting untruths about Asian Americans. First, Asian Americans are discussed as one monolithic group instead of a very diverse group of folks whose ethnic and cultural background span Western Asia, South Asia, East Asia, Southeast Asia, and includes Pacific Islanders who descend from Micronesia, Melanesia, and Polynesia.

Asian Americans and Systemic Racism

Asian Americans are used in arguments about how people of the global majority (an alternative to using the word Black, Indigenous, and other people of color) in the United States are not oppressed and are actually thriving. Elon Musk’s tweet is a perfect example of this. His comment that the US is a land of opportunity implies that because Asian Americans are not white and make more money than white people, that racism doesn’t exist and the need for things like affirmative action or DEI (i.e., diversity, equity, and inclusion) are not warranted. This same argument is used when discussing education attainment in the US.

Policies enacted by the US and state governments have discriminated against and excluded Asian Americans from access to property and resources throughout the history of our country, such as the Chinese Exclusion Act (1882), the Gentlemen’s Agreement (1907–1908), Alien Land Laws (1913, 1920), Naturalization Act of 1790, and Executive Order 9066. It wasn’t until the Civil Rights Act of 1964 that Asian Americans had full protection under the law.

The Perpetual Foreigner

Musk’s comment also plays into another racist trope that Asian Americans are all immigrants who recently came to America for opportunity. While 60% of Asian Americans in the US were born abroad, there are 40% who were born and raised in the United States. Asian Americans frequently are pressed to disclose where they are really from when giving locations located in the United States as to their place of origin. Othering and accusing people of not being American is a racist tool to justify policies that discriminate against people of the global majority. The rise of MAGA began with the birther movement, when Donald Trump accused Barack Obama of not being an American-born citizen.

Interpersonal Racism

Since the outbreak of COVID, Asian Americans have seen an increase of violence towards their community, due to the vilification of Chinese Americans by our then President, Donald Trump, who used China as the scapegoat for his failed COVID policies, referring to the virus as “Chinese Virus.” This led 32% of Asian Americans who responded to a Pew Research Center survey that they feared someone might threaten or physically attack them since the outbreak of COVID.

More recently, the GOP vice-president nominee, JD Vance, whose wife is Indian American has received backlash due to her not being white. Conservatives have voiced their distrust of Vance on certain policies due to his wife’s race and ethnicity.

Income vs. Wealth

When talking about the economics of race, it is important to distinguish between income and wealth. Just because someone has a higher income does not mean they have more wealth and vice-versa. In the United States, wealth is far more unequally distributed than income, since income is driven by the labor market, among other factors, and wealth is built primarily through the transfer of resources across generations. While income does impact wealth, other factors such as homeownership, retirement savings, education attainment, and job type are also factors in the US racial wealth gap.

The median net worth of an American family in 2022 was $192,900. Data from Pew Research in 2021 shows that the median net worth of Americans by race and ethnicity were as follows:

- White Americans — $250,400

- Black Americans — $27,100

- Hispanic or Latino Americans — $48,700

- Asian Americans — $320,900

- Multiracial Americans — $82,500

- Indigenous, Native American, Native Alaskan, and Pacific Islander — specific figures can vary, but generally lower than Black and Latino households.

To put this in more simple terms, for every dollar Asian Americans have, White Americans have $0.78, Multiracial Americans have $0.26, Hispanic or Latino Americans have $0.15, and Black Americans have $0.08.

Racial Wealth Disparity in the US

To understand why Asian Americans have the highest median household wealth and are often perceived as one of the wealthiest ethnic groups in the United States and groups such as Hispanic and Latino Americans and Black and African Americans have the lowest median household wealth, it is important to understand the placement of Asian Americans in American society and the factors that contribute to their wealth development, as well as historical policies and procedures that have disadvantaged Hispanic and Latino Americans and Black and African Americans.

Several factors have contributed to the economic success of certain Asian American subgroups:

-

Educational Attainment: Many Asian Americans have high levels of educational attainment. Immigrants from countries like India, China, and South Korea often come to the U.S. with advanced degrees and skills in high-demand fields like technology, engineering, and medicine, leading to higher-paying jobs.

-

Immigration Policies: U.S. immigration policies, such as the Immigration and Nationality Act of 1965, have favored skilled workers and professionals from Asia. This has resulted in a significant influx of highly educated and skilled immigrants who are well-positioned to succeed economically.

-

Cultural Emphasis on Education: Many Asian cultures place a strong emphasis on education and academic achievement, which can lead to higher educational attainment and better job opportunities. This cultural value can drive success in highly skilled and lucrative professions.

-

Entrepreneurship: Asian Americans have a strong presence in entrepreneurship, particularly in sectors like technology, healthcare, and small businesses such as restaurants and retail. Successful entrepreneurship can contribute significantly to wealth accumulation.

-

Community Support and Networks: Strong community support networks can help individuals find job opportunities, start businesses, and navigate challenges. These networks can provide valuable resources and support for economic advancement.

-

Geographic Concentration: Many Asian Americans live in metropolitan areas with robust economies and numerous job opportunities, such as Silicon Valley, New York City, and Los Angeles. These regions offer better access to high-paying jobs and business opportunities.

-

Family and Household Structure: Higher rates of multigenerational households and pooled resources within families can enhance economic stability and wealth accumulation. This structure can support investment in education and business ventures.

-

Access to Capital: Some Asian American communities have better access to capital through community lending circles, family investments, and ethnic banks. This access can facilitate entrepreneurship and investment.

-

Professional Networks: Participation in professional networks and organizations that support career advancement can provide Asian Americans with valuable connections, mentorship, and opportunities for career growth.

-

Economic Niche Strategy: Some Asian American subgroups have successfully occupied economic niches that offer high returns. For example, Indian Americans have a strong presence in the tech industry, while Chinese Americans have significant representation in entrepreneurship and small businesses.

While these factors have contributed to the economic success of certain Asian American subgroups, it’s important to recognize the significant diversity within the Asian American community. There are substantial disparities in income and wealth among different Asian ethnic groups, with some facing significant economic challenges and barriers to success.

The economic challenges faced by Hispanic and Latino Americans are multifaceted, stemming from a complex interplay of historical, structural, and systemic factors. Here are some key reasons:

-

Immigration Status: Many Hispanic and Latino Americans are immigrants or come from immigrant families. Undocumented immigrants, in particular, face significant barriers to economic opportunities, including limited access to higher-paying jobs, education, and social services. Many immigrants arrive to the US with no wealth, no substantial education, nor experience in higher-wage jobs.

-

Occupational Segregation: Many Hispanic and Latino workers are concentrated in low-wage and so-called “low-skill” jobs in industries such as agriculture, construction, hospitality, and domestic work. These jobs often offer limited opportunities for economic mobility and are vulnerable to economic downturns.

-

Health Disparities: Hispanic and Latino Americans face significant health disparities, including limited access to healthcare, higher rates of uninsured individuals, and poorer health outcomes. Health issues can lead to increased medical expenses and lost income, contributing to economic instability.

-

Language Barriers: Limited English proficiency can restrict access to higher-paying jobs, educational opportunities, and essential services. It can also limit the ability to advocate for better working conditions and wages.

-

Legal and Policy Barriers: Policies such as restrictive immigration laws and limited access to public benefits for undocumented immigrants can exacerbate economic challenges for Hispanic and Latino families. These barriers can limit access to education, healthcare, and economic opportunities.

Black and African Americans have been disproportionately disadvantaged by policies and practices throughout the history of the United States. Some of these policies and practices are:

-

Slavery: From the founding of the United States until the Civil War, the enslavement of African Americans provided economic benefits to white slave owners while systematically depriving enslaved people of any opportunity to accumulate wealth.

-

Jim Crow Laws: After the Civil War, these laws enforced racial segregation in the South and created significant barriers to economic opportunities for Black Americans.

-

Homestead Act of 1862: This act provided land to many Americans but largely excluded Black individuals, particularly former slaves, from obtaining land ownership.

-

Exclusion from New Deal Programs: In the 1930s, many New Deal programs, such as Social Security and labor protections, excluded domestic and agricultural workers, who were disproportionately Black.

-

Redlining and Housing Discrimination: The practice of redlining in the 1930s through the 1960s involved denying mortgages to Black families or restricting them to certain neighborhoods, which prevented them from purchasing homes and accumulating wealth. The Federal Housing Administration (FHA) policies reinforced these discriminatory practices.

-

GI Bill: After World War II, the GI Bill provided veterans with benefits for education and home loans. However, Black veterans faced significant barriers in accessing these benefits due to discrimination by banks, colleges, and local governments.

-

Discriminatory Banking Practices: Throughout much of the 20th century, banks engaged in discriminatory lending practices that prevented Black families from securing loans for businesses, homes, and education.

-

Urban Renewal: Mid-20th-century urban renewal projects often led to the displacement of Black communities, destroying homes and businesses without adequate compensation or relocation assistance.

-

Mass Incarceration: Policies from the 1970s onwards, such as the War on Drugs, have disproportionately targeted Black communities, resulting in higher incarceration rates, which have long-term economic impacts on individuals and their families.

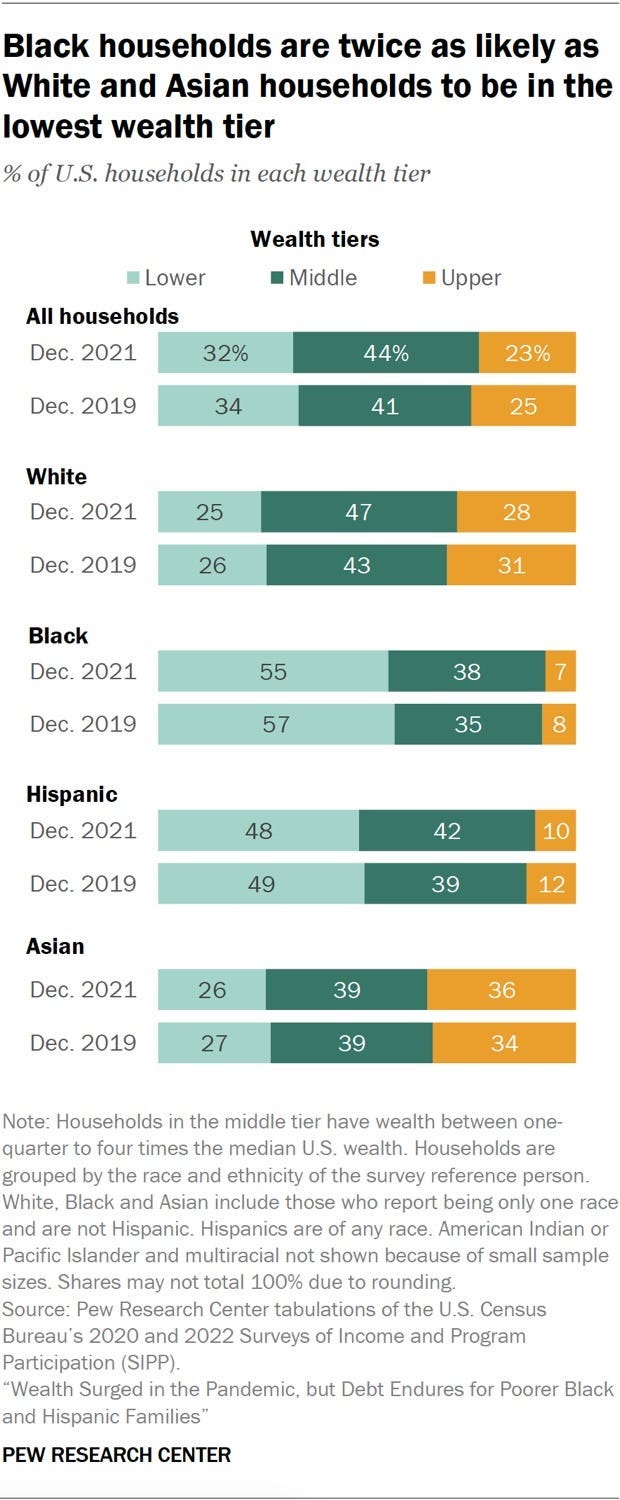

It is also important to look at the distribution of wealth across class tiers (e.g., lower, middle, and upper). According to Pew Research, Black households are twice as likely as White and Asian Households to be in the lowest wealth tier.

Educational Attainment

One of the biggest indicators of household wealth seems to correlate to educational attainment. The more educated a racial group as a whole is, the more likely they are to have higher household wealth. Below are the percentage of 25- to 29-year-olds who had attained different levels of education by race/ethnicity from 2022, according to the National Center for Education Statistics:

Hold a High School Diploma

- American Indian/Alaska Native 92%

- Asian 99%

- Black and African American 95%

- Hispanic and Latino American 88%

- Pacific Islander 90%

- White 97%

- Two or more races 97%

Hold an Associate’s Degree or Higher

- American Indian/Alaska Native 19%

- Asian 78%

- Black and African American 36%

- Hispanic and Latino American 34%

- Pacific Islander 36%

- White 56%

- Two or more races 48%

Hold a Bachelor’s Degree or Higher

- American Indian/Alaska Native 12%

- Asian 72%

- Black and African American 28%

- Hispanic and Latino American 25%

- Pacific Islander 28%

- White 45%

- Two or more races 35%

Hold a Master’s Degree or Higher

- American Indian/Alaska Native N/A

- Asian 31%

- Black and African American 6%

- Hispanic and Latino American 4%

- Pacific Islander N/A

- White 11%

- Two or more races 9%

According to National University, for doctoral degrees:

- In 2021, White students accounted for 63.36% of doctorate degrees conferred to U.S. citizens.

- Asian and Pacific Islander students accounted for 13% of doctorate degrees conferred to U.S. citizens.

- Black students accounted for 10% of doctorate degrees conferred to U.S. citizens.

- Hispanic students accounted for 9.65% of doctorate degrees conferred to U.S. citizens.

- Students of two or more races accounted for 3.38% of doctorate degrees conferred to U.S. citizens.

- American Indian and Alaska Native students accounted for 0.41% of doctorate degrees conferred to U.S. citizens.

- 46% of doctor’s degrees in a STEM field were conferred to U.S. non-resident students.

- Non-resident students accounted for 12.10% of total doctorate degrees conferred in 2021.

- In 2020, the three top countries of origin for visa holders earning a U.S. doctorate were China, India, and South Korea.

The data indicates a clear correlation between educational attainment and wealth in the United States. Generally, racial and ethnic groups with higher levels of educational attainment, particularly at the Bachelor’s degree level and above, tend to have higher median net worths. This suggests that access to and completion of higher education play a crucial role in economic stability and wealth accumulation.

Access to quality housing and well-funded schools significantly impacts the economic opportunities and overall well-being of all Americans. Quality housing in safe, well-resourced neighborhoods provides stability, security, and a conducive environment for personal and professional growth. For white Americans and Asian Americans, living in affluent neighborhoods often correlates with access to better educational institutions and resources, contributing to higher educational attainment and better job prospects. However, the diversity within these communities means that not all subgroups have equal access to these benefits, with some facing significant barriers to quality housing and education.

For Black and African Americans, historical and ongoing discriminatory practices such as redlining and housing segregation have led to concentrated poverty and limited access to quality housing. These practices have confined many to under-resourced neighborhoods with poorly funded schools, perpetuating cycles of poverty and limiting economic mobility. The lack of access to well-funded schools means fewer educational opportunities, lower academic achievement, and reduced prospects for higher education and well-paying jobs.

Similarly, Hispanic and Latino Americans often face residential segregation and housing discrimination, leading to high concentrations in low-income neighborhoods with underfunded schools. These conditions create significant barriers to educational attainment and economic advancement. Limited access to quality education restricts opportunities for college admission and career development, perpetuating economic disparities. Additionally, language barriers and immigration status can further complicate access to both housing and education for many Hispanic and Latino families.

Access to quality housing and education plays a crucial role in shaping the economic futures of Americans. While some subgroups within these communities may achieve economic success, systemic barriers continue to impede progress for many, necessitating comprehensive policy interventions to address these disparities. In summary, meritocracy and “pulling oneself up by one’s bootstraps” is a myth.